Retirement Savings Plans: New Contribution Limits for 2024

Contribution limits to the UC 403(b) and 457(b) Pre-tax and Roth Savings Plans have increased in 2024.

In 2024, you can contribute up to $23,000 in pretax and Roth contributions combined ($30,500 if you’re 50 or older) to each of the UC 403(b) and 457(b) Plans, for a total of $46,000 ($61,000 if you’re 50 or older) to both plans.

You can elect any combination of pretax and/or Roth contributions, subject to IRS limits.

Resources

- To enroll or change your contributions, sign in to your Fidelity NetBenefits account.

- For more information about the UC Retirement Savings Program, visit myucretirement.com.

- Call (866) 682-7787 and talk with a Fidelity representative about your options.

Local Support

- Email UC Davis Employee Benefits your questions at benefits@ucdavis.edu

- Attend a help desk hosted by UC Davis Employee Benefits

Benefits Summaries

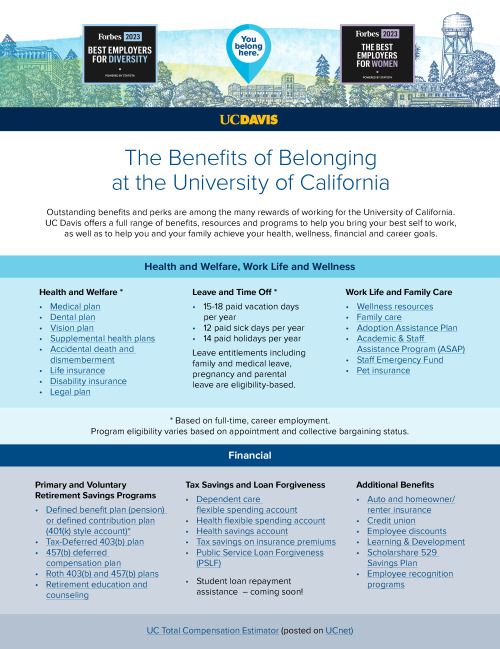

Outstanding benefits and perks are among the many rewards of working for the University of California.

Download and share: